Some services and interface elements mentioned in this article are only available in Ukranian.

What is FOP and why register it

FOP is "individual entrepreneur" in Ukraine.

Having registered as a FOP, you can:

- Withdraw earnings from your Admitad account to a bank account.

- Reduce taxes. A FOP only pays 5% of their earnings, while individuals have to pay 19.5%.

- Have official length of employment, confirmed income and place of work. These are the requirements for getting a visa, a loan, etc.

You will get a 5% tax rate if you register as a FOP and select the group 3 simplified tax regime (Single Tax).

You will need this group to cooperate with Admitad.

Learn more about the Single Tax and groups

Group 3 specifics:

- Income limit per calendar year: ₴7,002,000.

- Single Tax: 5% of income for non-VAT taxpayers (effective January 1, 2021).

- Single social contribution: 22% of the minimum salary (effective January 1, 2021).

- Paying the single tax every quarter (5% of the income).

- Keeping an income ledger (making records of each payment). Optional since January 1, 2021.

- Submitting a single tax declaration once a quarter.

- Submitting a single social contribution report once a year.

Most of the obligations can be delegated to special services like Taxer and iFin.

What one needs to do to register as a FOP

1. Select a KVED (Economic activity code).

It defines the activity in which the entrepreneur will be involved.

You can find the full list of KVEDs on the official website.

The following KVEDs can be used for cooperation with Admitad:

2. Get a digital signature.

- You can do it free in the Accredited Key Certification Center (AKCC) at any fiscal service office.

- You can also get a digital signature for a fee by contacting an organization authorized to issue digital signature keys to natural persons and legal entities.

3. Register as a FOP in one of the following ways:

How to register as a FOP on the website of the Ministry of Justice

1. Go to Electronic Services of the Ministry of Justice of Ukraine.

2. Hover over the "Registry of legal entities and individual entrepreneurs" and select "Application for state registration of a legal entity or individual entrepreneur."

3. Log in to or sign up for the system.

4. Create an application.

5. Use the digital signature.

6. Submit your application.

7. You can track the application status online. If the application was completed correctly, you will see a FOP registration statement on the electronic services portal.

You can collect the statement at the registrar office or wait until it arrives at the postal address you specified in the application.

8. Within 10 business days after registering as a FOP, go to the local tax office and:

- Submit a Single Tax application to become a Group 3 Single Tax payer.

If you fail to submit the application on time, you will be a general tax regime taxpayer and will have to pay 18% of your income (instead of 5%).

- Register an income ledger.

You can buy one at a stationery store. - Open a bank account for cashless settlements.

Done! Go to the following section: How FOPs cooperate with Admitad.

How to register as a FOP on Дія

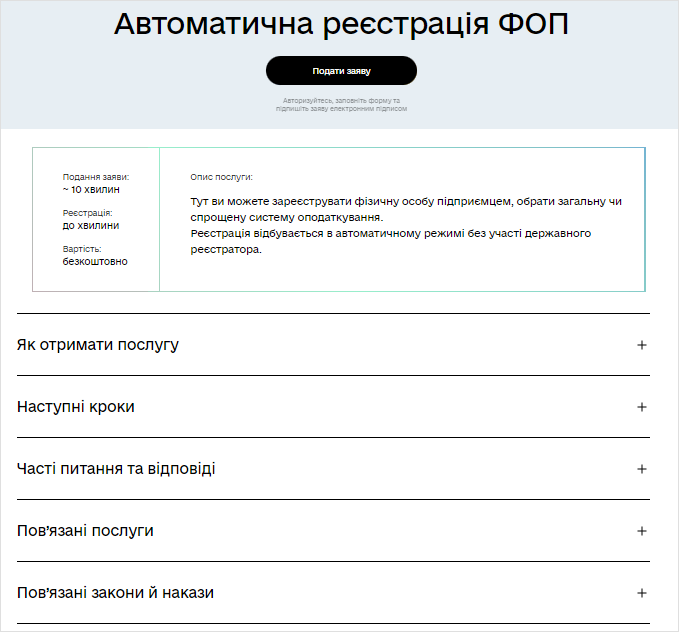

1. Go to the Дія Governmental Services Portal.

2. Go to the "Автоматична реєстрація ФОП" ("Automatic FOP registration") section.

For that, go to the "Громадянам" ("For citizens") tab and then jump to the above-mentioned section. You can also use the search bar on the home page.

3. Click "Подати заяву" ("New application") to create an application.

You can find the answers to the most common questions about registering as a FOP in the "Автоматична реєстрація ФОП" ("Automatic FOP registration") section.

Done! Go to the following section: How FOPs cooperate with Admitad.

How to register as a FOP offline

You can submit documents personally or through a representative (who should be duly authorized).

1. Contact your local state registrar.

You will need your passport and TIN and copies of these two documents.

2. Complete the FOP registration form.

You can download it here. You need to fill out a Form 10.

Be careful when indicating the KVED. You will only be able to make changes after registration—by submitting another application.

3. If all documents are correct, you will be registered and receive a statement the next day after submitting the documents.

If you sent your documents by mail, you will receive the statement by mail as well.

4., Within 10 business days after registering as a FOP, go to the local tax office and:

- Submit a Single Tax application to become a Group 3 Single Tax payer.

If you fail to submit the application on time, you will be a general tax regime taxpayer and will have to pay 18% of your income (instead of 5%).

- Open a bank account for cashless settlements.

Done! Go to the following section: How FOPs cooperate with Admitad.

How FOPs cooperate with Admitad

A FOP can withdraw their earnings to their bank account through Admitad Earnings Wallet.

For that, you need to:

- Conclude an agreement with Admitad.

- Add "Bank account" as a payment method.

You will need to complete the following steps for each further payment:

1. Create a withdrawal request.

4. Send the documents to Admitad.

If you have a minimum withdrawable amount on your account but don't have an agreement, you can transfer your funds to Admitad Earnings Wallet first, create a note and invoice for this amount, and submit them with the agreement. (How to submit documents for verification).

How to conclude an agreement with Admitad

To withdraw earnings through Admitad Earnings Wallet to a bank account as a FOP, you need to conclude an agreement with Admitad.

1. For that, create a request to Admitad support.

Subject: Concluding agreement with Admitad Ukraine

Description: Specify that you are going to enter into an agreement with Admitad Ukraine and provide your details:

- Full name

- Legal address

- TIN

- Bank details (current account number, bank, MFO)

2. Based on these details, a support agent will fill out the agreement template, send you the completed agreement for review, and ask you to specify the postal address to which the agreement will be delivered.

3. After the agreement is approved and signed on Admitad's end, the agreement will be sent, in two copies, to the postal address you specified in your request.

Sign it and send it to the following address:

Forum West Side Business Center, Floor 4, Unit 1, 6 Eleny Teligi Street, Kyiv, Ukraine 04112

How to add a withdrawal method

Follow this guide to add withdrawal method "Bank" to Admitad Earnings Wallet.

- As a withdrawal currency, select the currency of your bank account to avoid conversion.

- If this currency is not on the list, choose any other one.

How to withdraw funds

Once your earnings reach the minimum withdrawable about:

- Transfer your funds to Admitad Earnings Wallet following this guide.

- In Admitad Earnings Wallet, create a withdrawal request following this guide.

How to create a note and invoice

Download and complete the note and invoice templates.

How to generate a report

Generate a report in Admitad Earnings Wallet.

For that:

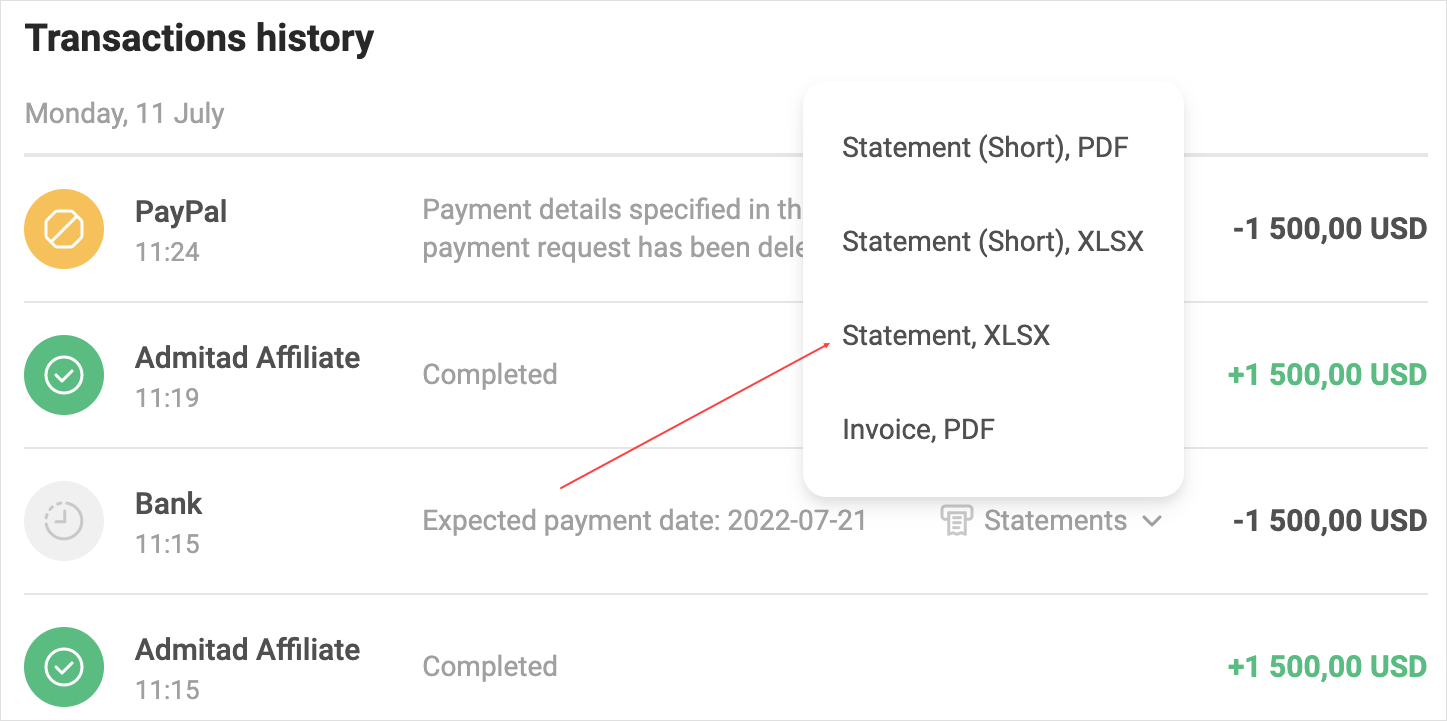

1. Go to Transactions history in Admitad Earnings Wallet.

2. Find the payment and download a detailed statement ("Statement") for it as an XLSX file.

If there are several payment requests, download all statements and combine them into a single file.

3. Open the statement file. Delete the "Program" column.

The file must contain the following columns: Admitad ID, Action time, Processing time, Reward amount.

4. Replace the following column names:

- Action time → Час дії

- Processing time → Час обробки

- Reward amount → Сума винагороди

Rename the file to "Admitad звіт ФОП/ТОВ (FOP name) до акту № … (note number) від (date) року."

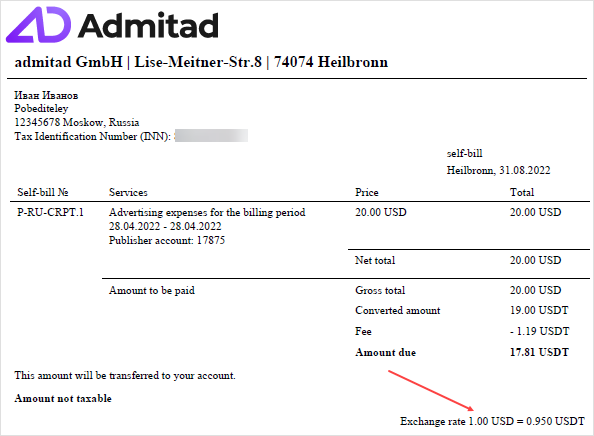

5. If you withdraw your earnings with exchange, specify the following formula in the next column after Reward amount:

reward amount * exchange rate

To find the exchange rate, download the invoice ("Invoice") from the Transactions history section. The rate will be specified in the bottom right-hand corner of the document.

6. Apply the formula to all cells.

7. Change the cell format to UAH.

8. Replace the original amounts in "Reward amount" to converted ones.

9. Specify the total amount at the bottom of the column.

If you are a VAT payer, specify the VAT amount and total amount including VAT.

10. Print the report. If the report has more than 1 page, only page the last one.

11. Put your signature and seal (if any).

How to submit documents for review

1. Send the note, invoice, and report to accountingua@admitad.com.

2. Admitad accountants will check if the documents are filled out correctly.

3. If everything is correct, send the original documents to the following address:

OOO "Admitad". Floor 4, 6 Eleny Teligi Street, Kyiv, Ukraine 04112. Tel.: (044) 392-05-12

You need to send the following documents:

- Invoice: 1 copy

- Note: 2 copies

- Report: 1 copy

When the withdrawal request will be processed

If we receive the original documents from you before Thursday, the payment will be completed on Thursday of the same week. Otherwise, the payment will be made next Thursday.